Summary

The client company’s relationship with its principal lender became strained in mid-2008 when results fell significantly short of projections and a $3 million projected profit turned into an $8 million loss. Hamstreet & Associates helped the borrower obtain a short-term extension of financing pending an objective assessment of viability and, if appropriate, development of a turnaround plan. Hamstreet & Associates then performed the assessment and recommended a turnaround plan, worked with the lender to extend financing for an additional year, and helped the company implement a turnaround yielding significant operating improvements. The client subsequently found new credit, opened a line of financing with the new lender, and enabled the original bank group to exit the loan.

The Background

Weak accounting systems and controls hid problems from view, leading to financial surprises, repeated failures to meet projections, and loss of credibility with the bank group.

Approximately two-thirds of the company’s revenue derived from large vegetable farming operations in Arizona and Mexico, with the remaining third coming primarily from a potato shipping business in Colorado. The company had strong strategic leadership with good customer relationships and solid food safety programs; it managed agriculture risks well and had capitalized on the margin growth of organic produce and potatoes. But it suffered from weak operational leadership, organizational complexity, excessive personnel and other costs, loose management practices, and inadequate reporting and benchmarking programs. The Mexican operation in particular was poorly integrated and lost significant amounts of money due to an ill-managed investment in new green onion processing technology. Weak accounting systems and controls hid these problems from view, leading to financial surprises, repeated failures to meet projections, and loss of credibility with the bank group.

The Challenge

The company’s problems came to a crux in 2008 when original profit projections supplied to the bank of $3 million deteriorated to $1.8 million and then, after a preliminary year-end audit, to a loss of ($2.2) million. This loss grew even larger after initial review revealed the need for an aggressive clean-up of questionable assets and for the elimination of likely capital call liabilities on certain investments. The company’s loss for the year ended May 31, 2008, reached nearly ($8.0) million.

Successful liquidation of the business was unlikely due to collapsed land and equipment values and unavailability of purchase financing.

Meanwhile, on a national level, the banking crisis leading up to the collapse of Lehmann Brothers and bailout of AIG was picking up steam, rendering the company’s prospects of finding a new lender close to nil. At the same time, successful liquidation of the business was unlikely due to collapsed land and equipment values and unavailability of purchase financing. Hamstreet & Associates assisted the company in recognizing its weaknesses and recommended a program of cutting costs, increasing profits, paying down debt, and improving management.

Based on Hamstreet & Associates’ advice, the company took the following actions:

- Created a managerial position to be responsible for Mexico operations;

- Created a strong COO position to lead all operations and report to the existing CEO, eliminating an overly flat reporting structure;

- Reduced payroll costs by nearly $3 million through elimination of positions, reduction in the number of U.S. residents commuting to Mexico, reduction in the number and expense of company vehicles, and elimination of company credit cards;

- Reduced hail-sensitive operations in Colorado;

- Eliminated investments in operations that would require extensive capital contributions in the near future;

- Incorporated Mexican accounting results into the business-wide accounting system on a monthly basis rather than annually as had been the case;

- Installed a new accounting software system to reduce reliance on spreadsheets, eliminate repetitious data entry, and provide superior management reporting tools; and

- Consolidated green onion processing into one facility instead of two.

The Results

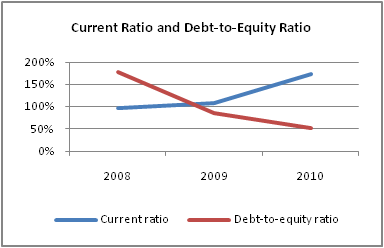

The company’s financial results in 2009 and 2010 showed marked improvement compared to the 2008. Earnings went from a loss of ($7.9) million in 2008 to gains of $4 million in 2009 and $6.7 million in 2010. Liquidity and solvency improved dramatically as liabilities decreased and equity grew (see chart).

Prior to the turnaround the company contemplated selling core production land in Colorado to reduce debt and save the business. Thanks to the success of the turnaround, the company did not have to sell this land and was able to obtain lower-cost stable financing.